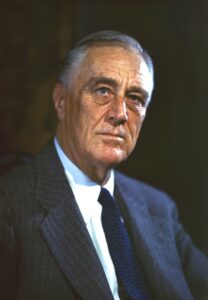

Democratic (socialist/fascist) de facto President Franklin Roosevelt, Esq.—without a constitutional amendment—signs the Internal Revenue Act of 1934:

- Decreasing the number of personal “income” tax brackets from 54 to 30;

- Maintaining the lowest personal rate on the first 4,000 “dollars” at 4%;

- Maintaining the highest personal rate on amounts earned over 1,000,000 “dollars” at 63%;

- Maintaining the corporate rate on income (profits) at 13.75%;

- But raising the surtax (progressive rates) on incomes of 4,000 from one to five percent and 55% to 59% on incomes over 1,000,000 “dollars.”

NOTES:

- As an attorney (Officer of the Court) Roosevelt was ineligible to serve in two branches of government at the same time, according to Article I, Section 6 [Clause 2]

- This is the further realization of plank number two of the “Communist Manifesto” by Karl Marx.

[updated 4/19/2025] Thanks to Bill Holmes for this entry.

Subsequent Events:

Authority:

“Law of the Jungle”

ccc-2point0.com/preface

References:

Encyclopedia of Banking and Finance, s.V. “New Deal,” 753.

Revenue Act of 1934 – Wikipedia, the free encyclopedia

en.wikipedia.org/wiki/Revenue_Act_of_1934

Revenue Act of 1932 – Wikipedia, the free encyclopedia

en.wikipedia.org/wiki/Revenue_Act_of_1932

Corporate Income Tax: Definition, History, Rate

www.thebalance.com/corporate-income-tax-definition-history-effective-rate-3306024

Communist Manifesto 10 Planks

www.libertyzone.com/Communist-Manifesto-Planks.html