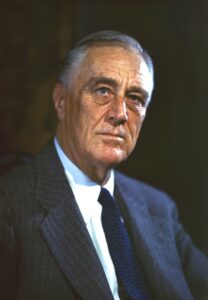

Democratic (socialist/fascist) de facto President Franklin Roosevelt, Esq., signs the First Internal Revenue Act of 1940:

- Decreasing the number of personal “income” tax brackets from 32 to 31;

- Decreasing the number of corporate profits (income) tax brackets from 4 to 2;

- Increasing the lowest corporate rate on the first 2,000 “dollars” earned from 8% to 19% of the first 25,000 “dollars” earned;

- Increasing the highest corporate rate on amounts earned over 40,000 “dollars” from 15% to 33% on amounts earned over 25,000 “dollars”;

- Increasing the lowest personal rate on the first 4,000 “dollars” earned from 4% to 8%; and

- Maintaining the highest personal rate on amounts earned over 5,000,000 “dollars” at 79%.

NOTES:

- This is the further realization of plank number two of the Communist Manifesto by Karl Marx.

- As an attorney (Officer of the Court) Roosevelt was ineligible to serve in two branches of government at the same time, according to Article I, Section 6 [Clause 2].

[added 5/3/2025]

Subsequent Events:

Authority:

“Law of the Jungle”

ccc-2point0.com/preface

References:

First Revenue Act of 1940, 53 Public Statutes at Large 863 (1940).

Revenue Act of 1940 – Wikipedia

en.wikipedia.org/wiki/Revenue_Act_of_1940

Corporate Income Tax: Definition, History, Rate

www.thebalance.com/corporate-income-tax-definition-history-effective-rate-3306024

Communist Manifesto 10 Planks

www.libertyzone.com/Communist-Manifesto-Planks.html